Trust Administration Attorneys in California Helping You Act as a Responsible Trustee to Avoid Legal Trouble and Family Conflict

The role of a trustee is crucial in protecting the deceased’s assets. Handling a trust administration—including managing assets, distributions, and filings—is complex, time-sensitive, and delicate. Under California law, a trustee’s responsibilities must be handled with care and attention to detail to avoid legal issues and probate court.

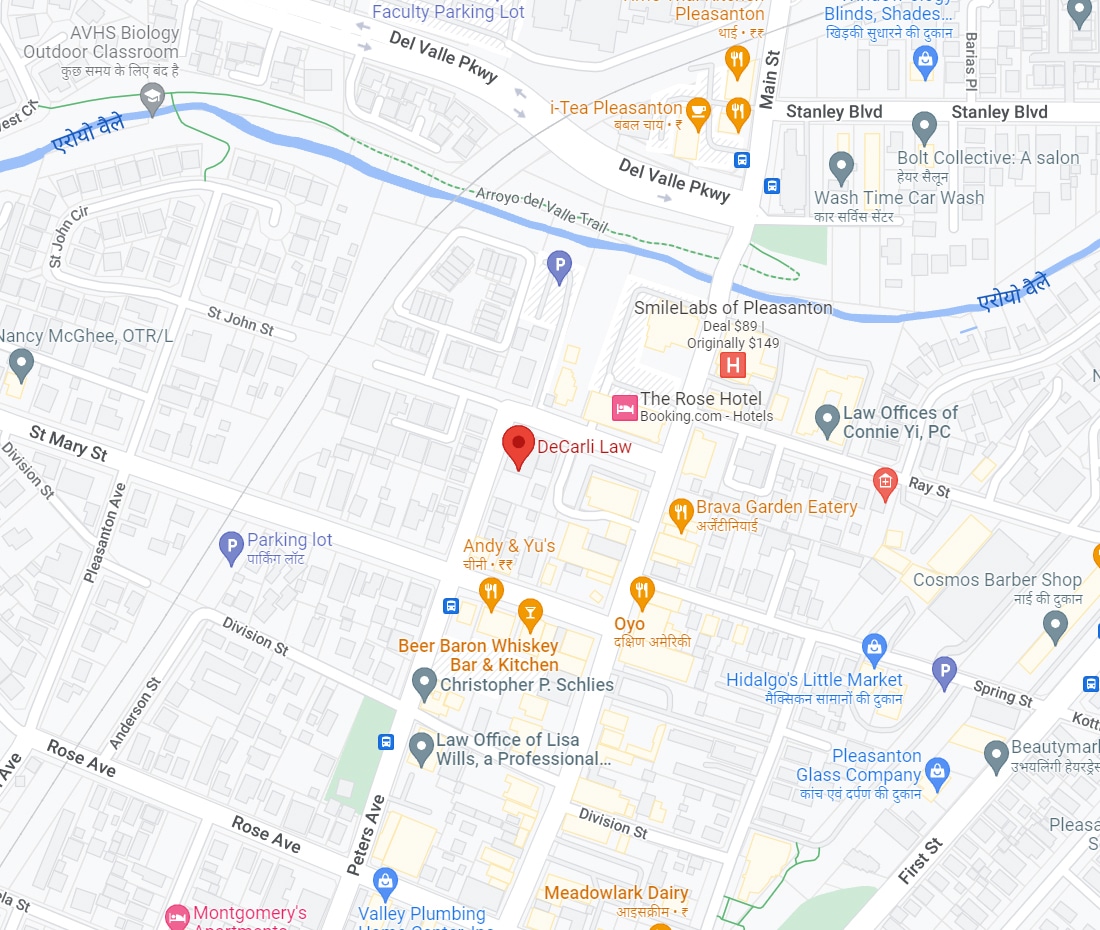

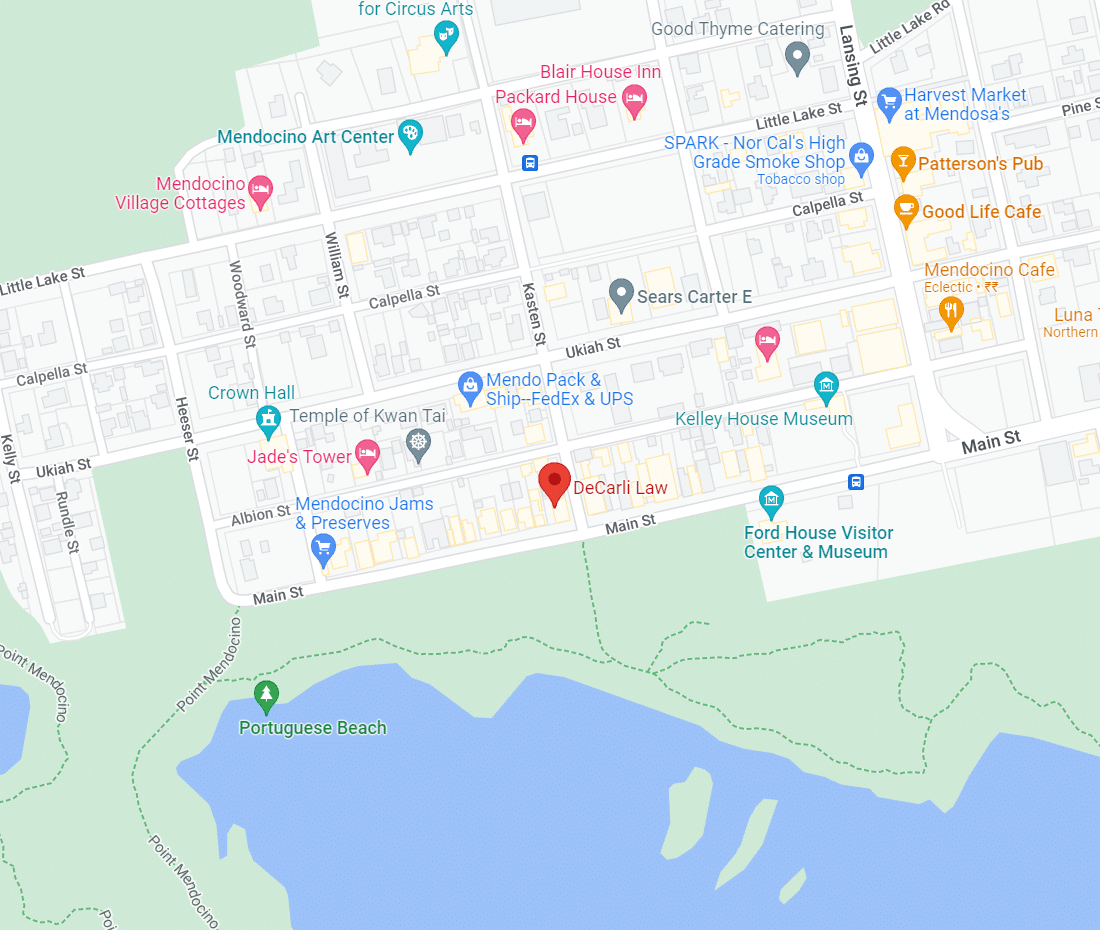

Decarli Law and our team of experienced trust administration lawyers can make the trust administration process and distribution of assets seamless when determining who should receive what and upholding critical fiduciary responsibilities.

Navigate the trustee process easily, follow the administrative protocols, prevent legal consequences, and ensure you’re in a position to do right by the deceased. Contact Decarli Law and get needed legal counsel and support.

What are the Responsibilities of a Trust Administrator?

A trust administrator or “trustee” must explicitly follow the outlined responsibilities when overseeing a decedent’s trust. An administrator must act by the estate planning documents written rules, communicate with all parties appropriately (all the beneficiaries), and maintain the finances within the account.

To avoid a breach of fiduciary duty, a trustee has the following trust administration process responsibilities:

- Duty of loyalty—a trustee must always act in the best interests of the beneficiaries as stated in the trust

- Duty of disclosure—a trustee must disclose information to all beneficiaries and keep everyone informed regarding the status of the trust

- Duty of impartiality—a trustee must treat all beneficiaries equally

- Duty to enforce and defend claims—a trustee must enforce claims when reasonable and practical, even if claims cause loss to the trust

Any questions regarding trustee management should be directed to experienced trust administration legal counsel. We can help — contact Decarli Law today to discuss laws regarding trustee duties.

What Happens if the Trustee Fails to Follow Orders?

There are clear instructions as part of a trust administration. Not adhering to the rules, lack of—or poor performance—and other misgivings can result in a breach and a lawsuit.

Trustee responsibilities are held in high regard, and any faulty behavior, if identified, can lead to personal liability.

What constitutes a breach of trust is up to the court’s discretion, though common examples include:

- Intentional or negligent decisions that harm the trust’s assets or beneficiaries

- Self-serving decisions

- Mistakes or errors

- Omission of information

- Retaliatory conduct on the part of the trustee

Failure to follow orders puts the trustee at personal risk and the beneficiaries involved, especially if there’s negligent behavior. Avoid this situation at all costs, as your duties can be revoked if called into question, and you could face a lawsuit if you acted carelessly.

Can a Trustee Refuse to Pay a Beneficiary?

One thing is certain—trustees are legally obligated to comply with the terms and conditions of trust. With any legally binding contract, the written language will dictate how trust is executed, including any payouts to any beneficiaries. This also includes exemptions to any beneficiaries that might have been disinherited.

A trustee can refuse to pay a beneficiary if they request money or assets above and beyond what’s rightfully theirs if the trust excludes this particular person or it’s written in the trust. An estate planning attorney from California can help a trustee examine the language to clear up misunderstandings and avoid litigation quickly.

When in doubt, contact Decarli Law to discuss the details of a trust.

How Can a Trust Administration Lawyer Help Me?

There are consequences to poor trust management and execution and a poorly constructed estate plan—all avoidable things with a good and experienced trust administration lawyer like Decarli Law.

We help with estate planning to ensure all legal documents, from wills to trusts and more, are clear and concise to leave little room for question, conflict, or confusion. Appointed trustees rely on us for support and legal counsel to ensure proper distribution of assets, and beneficiaries come to our firm if there’s negligent behavior.

The proper legal counsel is an antidote to many trust-related mistakes and will save you hundreds—even thousands of dollars—in the long run. Contact our experienced trust administration attorney for assistance with your trustee responsibilities, or call 707-937-2701 for a consultation.