California Trusts Lawyers Helping Families Fulfill Financial Obligations

When many people hear about estate planning, they think this simply means having a will. But there are many other ways to protect the beneficiaries of your wealth after you die. One of those is to create a trust to protect your assets from probate law in California. Estate litigation can be costly, reducing the amount your family and other beneficiaries receive from you and can delay your loved ones as they have to wait for the probate process in order for the funds from your bank accounts or other assets to be distributed. With a knowledgeable law firm on your side, you can set up a trust that provides security for your family, which can give you peace of mind, especially if your family is non-traditional, making it harder for your loved ones to inherit from you. This means that for blended families with stepchildren, grandparents who have custody of children, and many other unique circumstances, the administration of your property will take place along with your wishes.

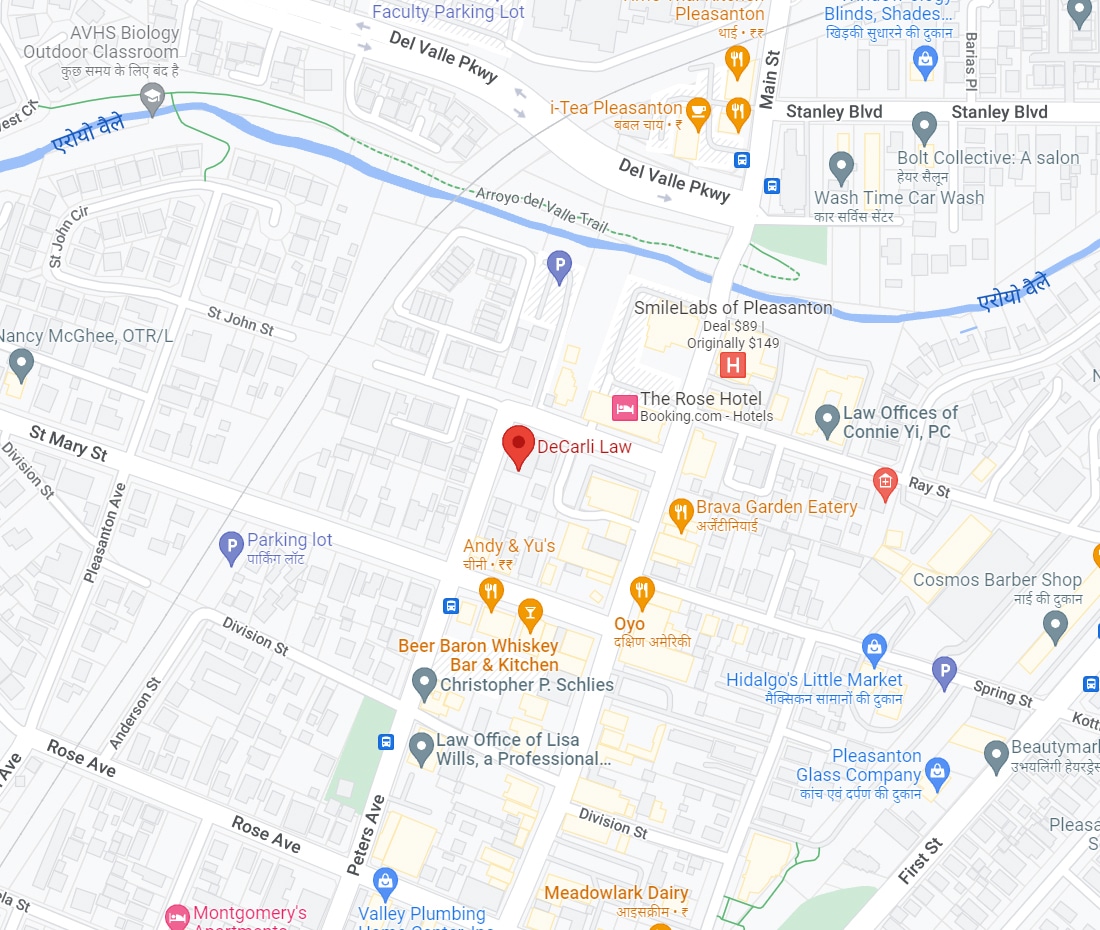

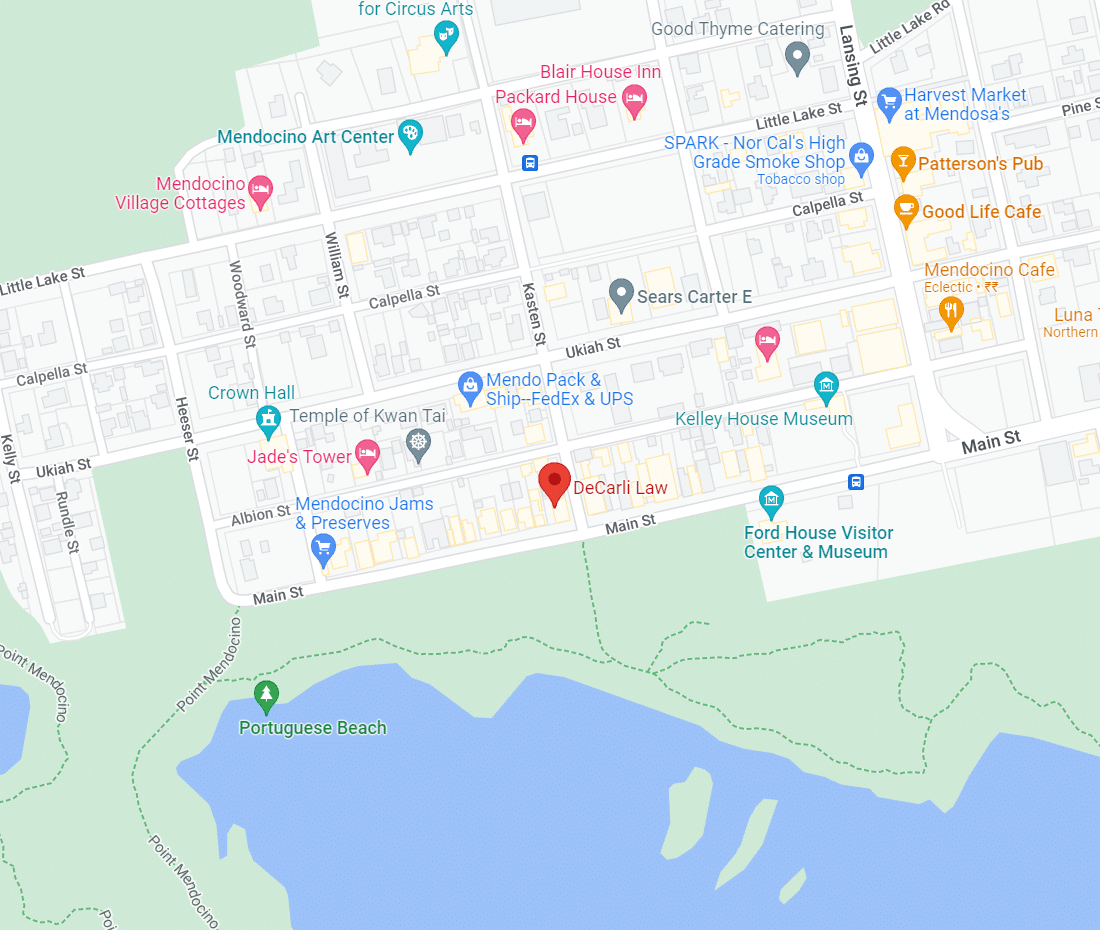

The office of DeCarli Law is located in the beautiful coastal vacation town of Mendocino. Attorney DeCarli can assist clients anywhere in California and is happy to conduct virtual and telephone meetings. Contact us today to schedule a initial consultation where you can speak with one of our compassionate and highly skilled attorneys at (707) 937-2701.

What Is a Trust?

A trust is a type of financial account that is set up using a legal document. The document names a person or institution as the trustee. It is the trustee’s responsibility to administer the trust funds and disburse the trust’s assets in accordance with the terms in the trust document. The individual(s) or organization that receives distributions from the trust are called the beneficiaries of the trust. Trustees act in a fiduciary capacity in administering the trust, which means they are held to a very high legal standard in fulfilling their responsibilities of trust administration to the beneficiary.

There are two basic types of trusts: revocable and irrevocable. As the name implies, a revocable trust can be revoked or changed by the creator—also referred to as the grantor. In contrast, when an irrevocable trust is created, the creator of the trust permanently relinquishes all rights to the trust assets, and the trust cannot be revoked, terminated, or changed.

Establishing a trust can be a valuable part of your estate planning needs, protecting a surviving spouse or family member from having to pay taxes unnecessarily and giving them financial security. With the importance of the legal process of setting up trust property, you want to know everything is done properly. You can look to our skilled trust lawyers for help with any needs regarding estate administration.

What Are Some Common Types of Trusts

Trusts are created for many different reasons. They are an important tool in estate planning and often are created as part of a comprehensive estate plan. Some of the more common types of trusts are:

Living Trust

One type of trust that many people are familiar with—or have at least heard of—is called a living trust, sometimes also referred to as an inter vivos trust. Assets that are transferred to a living trust during the grantor’s lifetime are protected from probate, which refers to the formal court-supervised process of administering and distributing an estate after someone dies.

A living trust is a revocable trust, so it can be terminated, changed, or revoked during the grantor’s lifetime. It becomes irrevocable on the grantor’s death. Most often, the grantor names himself or herself as a trustee during his or her lifetime. The trust also names a successor trustee to become responsible for administering the trust to the beneficiaries for the benefit of the grantor’s heirs after his or her death.

A living trust is usually created in conjunction with a will. Northern California estate planning attorney Debra DeCarli can help you decide whether a living trust is right for you.

Testamentary Trust

A testamentary trust is a trust created by a will, which goes into effect and becomes irrevocable on the death of the person making the will.

AB Trusts

AB trusts—or A-B trusts—are made by married couples as part of their estate plan to maximize the use of the federal estate tax exemptions for both spouses. The trusts can be set up under a will or revocable living wills. Other terms sometimes used for these trusts are marital trust, QTIP trust, marital deduction trust, bypass trust, or family trust.

Special Needs Trust

A special needs trust is set up to improve the quality of life for a person with special needs or disabilities, without affecting the beneficiary’s eligibility for government benefits. Special needs trusts can be revocable or irrevocable, depending on the specific circumstances, but in most cases, they need to be irrevocable to be effective.

Charitable Trust

A charitable trust is an irrevocable trust that benefits one or more charitable organizations. The trust can be set up during the donor’s life or as a testamentary trust that takes effect on the donor’s death. There are several different variations on charitable trusts.

What Are Some Reasons for Using a Trust?

There are a number of different reasons for setting up a trust. Avoiding probate and saving estate taxes are the primary reasons they are used in estate planning. A trust also protects your privacy. When an estate goes through probate, all of the information about the estate is available to the public. In contrast, trusts keep the information private. Using a trust can also avoid significant probate expenses. For many families, they can be the answer to protecting the financial future of the beneficiaries by reserving money and property held by the grantor. If you are considering a trust in your estate planning, you need a trust attorney who knows how to find the right solutions for your unique needs and who can protect your assets for the future. The DeCarli law firm has the skill and experience you need to get the results you want, so give us a call today at (707) 937-2701.

Should You Hire Our Northern California Trusts Attorneys?

If you are considering a trust as part of your estate plan or for other reasons, schedule a initial consultation with Northern California attorney Debra DeCarli. After discussing your situation and wishes, Attorney DeCarli will work with you to determine what options are available and best suited for your circumstances. She also provides a full range of estate planning services for clients throughout California. Use the DeCarli Law online contact form or call (707) 937-2701 or (800) 402-4720 to set up a no-cost telephone, in-person, or virtual consultation.