Congratulations on the purchase of your new home! As a homeowner, whether this is your first home or an upgrade or downsize, your home is a significant asset. Below are a few things for you to consider now that you finally have the keys to your new home.

1. If You Don’t Have a Trust, This is the Perfect Time to Set One Up.

You have just signed the paperwork on what is probably your most valuable asset. Now is the time to protect that asset for your family. For example, in California, if your estate goes through probate, your heirs will have to pay statutory probate fees on your estate. The fees are based on the value of the house–whether or not you owe money on a mortgage! So your very modest $600,000 California house would owe $15,000—$30,000 in probate fees, regardless of the amount owed on the mortgage. A revocable living trust costs a fraction of that amount and completely avoids probate.

2. Make Sure Your House Title Coordinates With Your Estate Plan.

While it is still fresh in your mind, reference your new deed to see how the property is titled. If you live in a community property state such as California or Texas, you will want to be sure that the deed correctly reflects whether your new property is a community or separate property.

Then, you will want to reference your estate planning documents to make sure that your property has been titled properly to achieve your estate planning goals.

For example, if your previous plan had a specific provision distributing your old property, you will want to make sure that you update this provision since you no longer own the previous property. On the other hand, if this is your first home and your estate plan includes a trust to avoid probate, you will need to make sure that your home was titled in the name of the trust and not in your name individually or named as a couple.

3. Check Your Life Insurance Coverage and Beneficiary Designations.

Unless you were fortunate enough to pay cash for your new home, chances are you now have a large monthly mortgage expense. In order to protect your loved ones, it is important that you check your life insurance coverage. Should you die before paying off the mortgage, it is a good idea that you have enough life insurance to meet that obligation should you have a surviving spouse or children that will likely continue to reside in the home. Even if they choose to not remain in the home, life insurance can provide valuable assets during what is usually an emotionally difficult time.

This is also a great opportunity to double-check your beneficiary designations. Life changes happen so quickly that sometimes this can be overlooked. If your designations do not match up with the rest of your estate plan, you may end up inadvertently disinheriting a family member or having the money fall directly into the hands of an individual without any guidance.

Lastly, now that you have a home and homeowner’s insurance, call your insurance agent to make sure that you are getting all of the discounts that you are entitled to. Many insurance companies will offer discounts when you bundle services. If you already have car insurance through a carrier and use the same company for your homeowner’s insurance, you may be entitled to a better rate than if you had both policies separately. In addition, homeowners often get discounts that renters don’t.

We’re Here to Help!

Buying a new home is a big step and we are here to help. Give us a call and we can help make sure that your new purchase and estate planning are working together to carry out your goals.

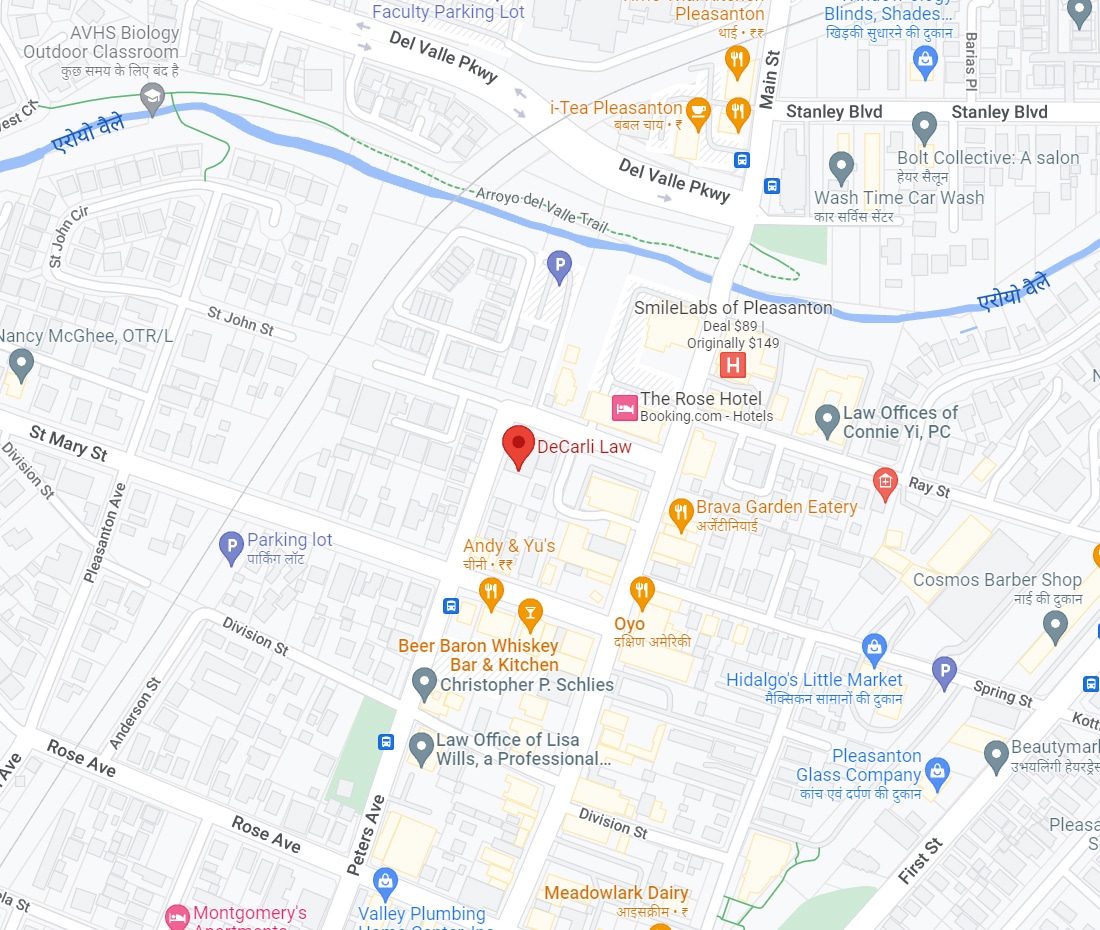

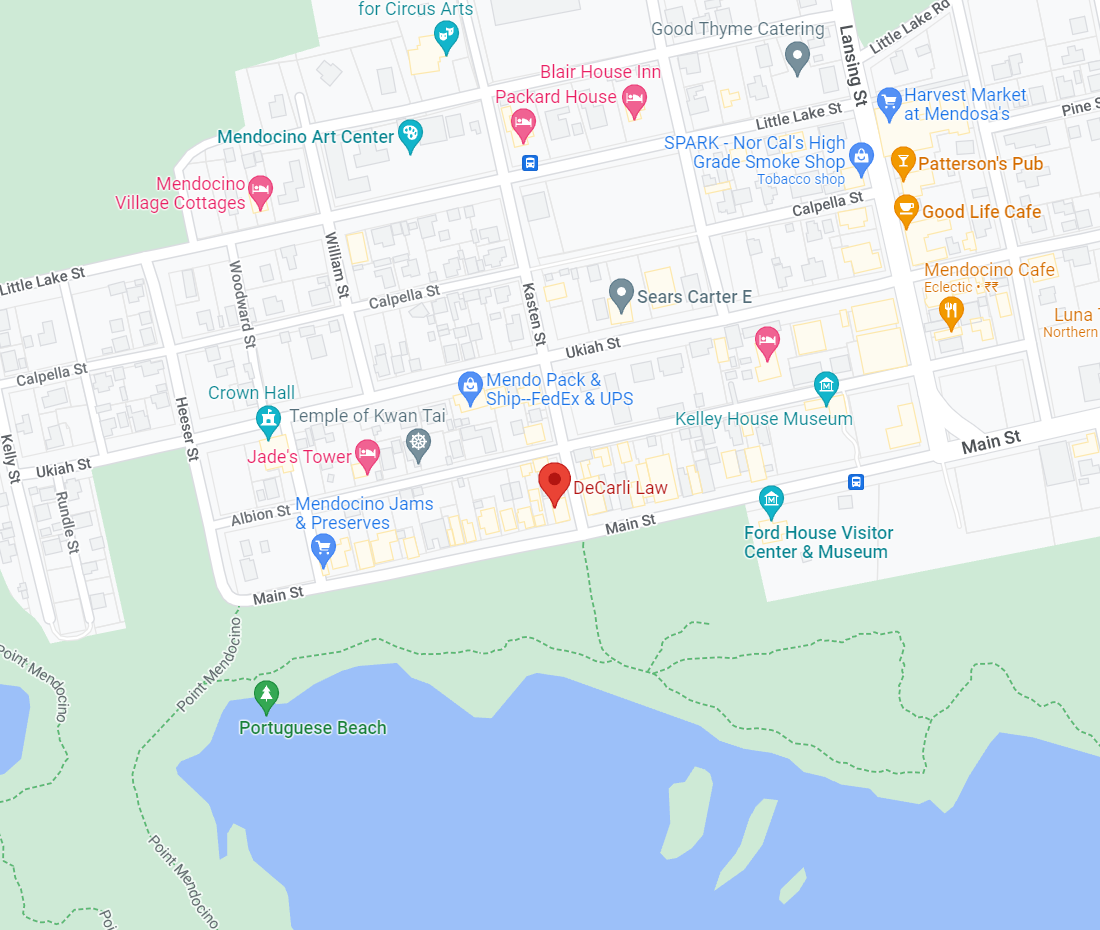

If you would like to learn more about creating an estate plan specific to you and your family call us for a initial consultation at

(707) 937-2701

email me at debra@decarlilaw.com

or use our online calendar to schedule an appointment